| | | |||||||

Date: | | | April | |||||

Time: | | 4:00 | ||||||

Place: | | 3421 Hillview Avenue, Palo Alto, California | ||||||

Record Date: | | | February 22, 2024 | |||||

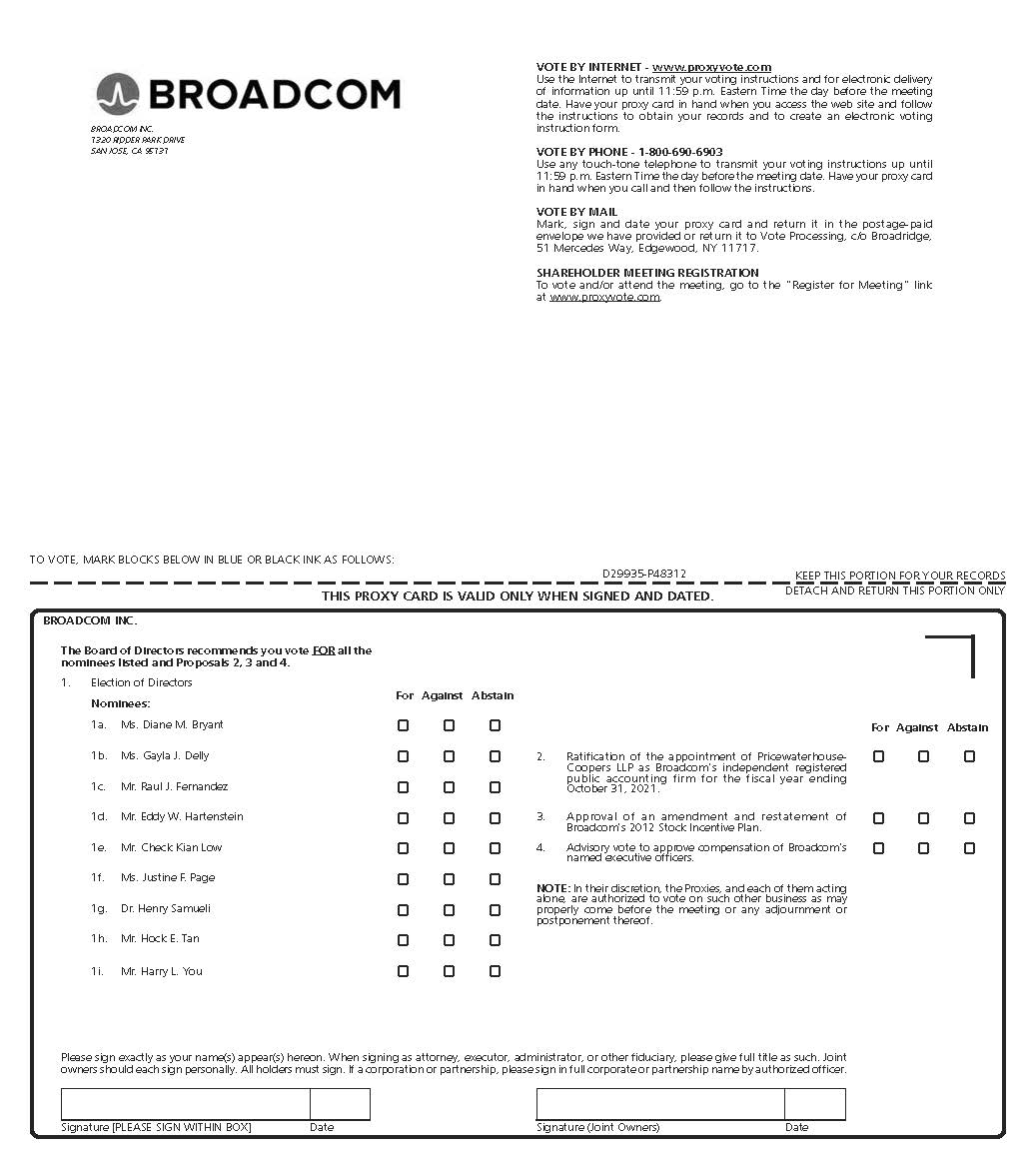

Items of | | 1. To elect each of the nine director nominees | ||||||

| | 2. To ratify the appointment of PricewaterhouseCoopers LLP | |||||||

| | 3. To hold an advisory vote to approve the | |||||||

| | 4. To transact any other business as may properly come before the meeting or any postponements or adjournments to the meeting. | |||||||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | |

BROADCOM INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | | | ||||||

No fee required. | ||||||||

☐ | | | Fee paid previously with preliminary materials. | |||||

☐ | | | Fee computed on table | |||||

NOTICE OF 20212024 ANNUAL MEETING OF STOCKHOLDERS

Vote via the Internet You can vote your shares online at www.proxyvote.com |

Vote by Telephone In the U.S. or Canada, you can vote by calling (800) 690-6903 |

Vote by Mail Complete, sign, date and return your proxy card in the postage- paid envelope |

These items of business are described more fully in the accompanying Proxy Statement. We will be providing access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. As a result, onOn or about February 19, 2021,26, 2024, we are mailing to mostBroadcom’s stockholders at the close of Broadcom’s common stockholdersbusiness on the Record Date a noticeNotice of availabilityInternet Availability of proxy materials instead of a paper copy of the Proxy Statement and our 2020 Annual Report.Materials.

Your vote is important. Regardless of whether you plan to participate in the Annual Meeting, we hope you will vote as soon as possible. Voting willpossible via the Internet, by telephone or by mail to ensure you are represented at the Annual Meeting, regardlessMeeting. Instructions for using these voting methods are set forth on the proxy card or the Notice of whether you plan to attend the Annual Meeting. You may cast your vote over the Internet by telephone, by mail or during the Annual Meeting.Availability of Proxy Materials.

Important notice regarding theof internet availability of proxy materials for the Annual Meeting to be held on April 5, 2021:

:

:

The notice of meeting, Proxy Statement and annual report to stockholders2023 Annual Report are available at http:https://investors.broadcom.com.

Hock E. Tan

Director, President and Chief Executive Officer

February 26, 2024

TABLE OF CONTENTS

| | |||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | |  | | | i |

Dear Broadcom stockholders:

On behalf of the entire Proxy Statement before voting.

|  |  | ||||||

VMware Acquisition

We are thrilled to have completed the VMware acquisition in November 2023, which brings us closer to achieving our long-term strategic goal of building the world’s leading infrastructure technology company. Our executive officers demonstrated strong leadership and exerted tremendous effort in fiscal 2023 to complete this acquisition in the midst of a cumulative TSR increasechallenging regulatory and geopolitical environment.

Board Composition

In February 2024, the Board appointed Kenneth Hao as a member of 34.0% annually on average.the Board. Mr. Hao brings to the Board valuable experience as chairman and managing partner of Silver Lake and deep knowledge of the software industry at a time when integrating the VMware business and employees is a top priority for Broadcom.

Succession Planning

We consider CEO and senior management succession planning to be one of the Board’s primary responsibilities and the Board is actively engaged in this area. We have a CEO succession plan in place that we believe would minimize disruption in our business and preserve operational continuity should the need arise to implement this plan.

Executive Compensation

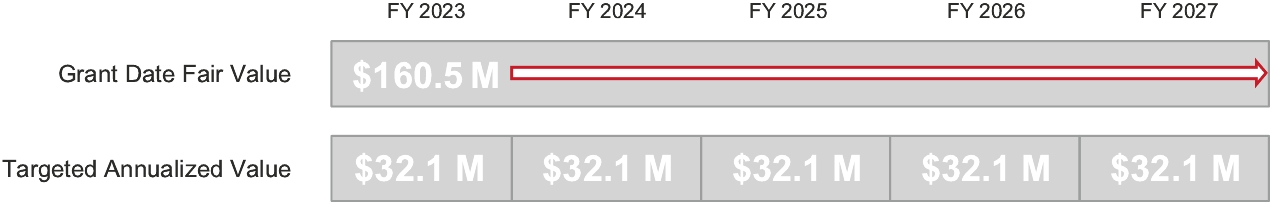

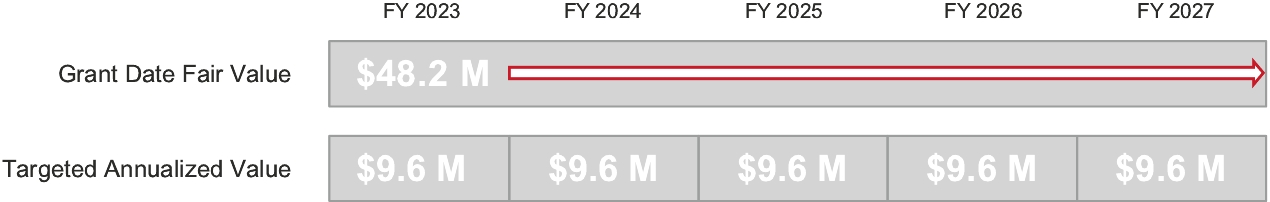

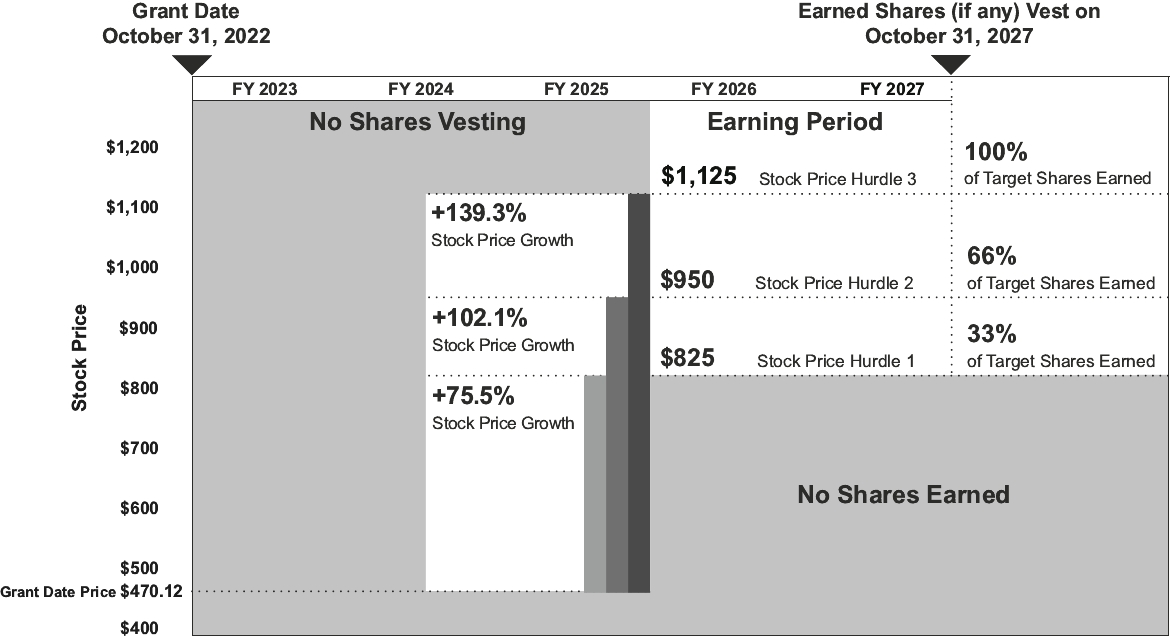

To retain and motivate Hock Tan, President and CEO, and Charlie Kawwas, President, Semiconductor Solutions Group, the independent members of the Board granted Mr. Tan and the Compensation Program GovernanceCommittee granted Dr. Kawwas performance stock unit (PSU) awards in fiscal 2023 that require (i) achievement of formidable stock price performance hurdles and (ii) continued service over a five-year vesting period.

Mr. Tan’s fiscal 2023 PSU award was front-loaded to cover the market-based value of both his annual cash and long-term incentive opportunities over a period of five years. Dr. Kawwas’ fiscal 2023 PSU award was also front-loaded to cover the market-based value of his annual long-term incentive opportunities over a period of five years. The annualized GAAP value of these PSU awards was in line with our compensation peer group benchmarks. During the five-year vesting period, we do not intend to grant annual equity awards to Mr. Tan and Dr. Kawwas and Mr. Tan will not be eligible to receive annual cash incentive payouts because these PSU awards were front-loaded.

| | |  | | | 1 |

These PSU awards are 100% at risk and deliver value to Mr. Tan and Dr. Kawwas only if our stockholders receive significant and sustained value appreciation. Additional disclosure on the methodology and design of these PSU awards is provided below in “Compensation Discussion and Analysis.”

Stockholder Engagement and Responsiveness

Although we have a steady history of robust engagement with our stockholders, the level of support received for our Say-on-Pay proposal at last year’s annual meeting indicated that we should increase the level of our stockholder engagement on executive compensation and we have intentionally done so.

At these meetings, our stockholders acknowledged our executive officers’ extraordinary performance in growing stockholder value, but also provided feedback on the incremental PSU award granted to Mr. Tan in fiscal 2022. In response to the feedback, the Board and the Compensation Committee have made commitments regarding special performance awards outside the regular annual equity grant cycle. More information about our response is provided below in “Stockholder Engagement.”

Your continued support and vote is important to us. We hope that our actions convey an unwavering pursuit of sustainable future excellence consistent with expectations built on our remarkable achievements to date. We encourage you to read this Proxy Statement and vote your shares.

Sincerely,

Henry Samueli, Ph.D.

Chairman of the Board

2 | | |  |

Your proxy is being solicited by the Board of Directors of Broadcom Inc. (the “Board”) in connection with the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). We are making the Notice of Internet Availability of Proxy Materials (the “Internet Notice”), this proxy statement (the “Proxy Statement”) with the proxy card and our Annual Report on Form 10-K for the fiscal year ended October 29, 2023 (the “2023 Annual Report”) available to stockholders at the close of business on February 22, 2024 (the “Record Date”) on or about February 26, 2024. This summary highlights information contained elsewhere in this Proxy Statement. We encourage you to review the entire Proxy Statement before voting.

Unless the context otherwise requires, references in this Proxy Statement to “Broadcom,” “we,” “our,” “us” and similar terms are to Broadcom Inc.

PROPOSALS AND BOARD RECOMMENDATIONS

Proposal | | | Board Recommendation | | | Page | |||

1. | | | To elect each of the nine director nominees until the next annual meeting of stockholders or until their successors have been elected | | | For each director nominee | | | |

2. | | | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Broadcom for the fiscal year ending November 3, 2024 | | | For | | | |

3. | | | To hold an advisory vote to approve the named executive officer compensation | | | For | | | |

DIRECTOR NOMINEES

Name | | | Independent |

Diane M. Bryant | | |  |

Gayla J. Delly | | |  |

Kenneth Y. Hao | | |  |

Eddy W. Hartenstein (Lead Independent Director) | | |  |

Check Kian Low | | |  |

Justine F. Page | | |  |

Henry Samueli, Ph.D. (Chairman of the Board) | | |  |

Hock E. Tan (President & CEO) | | | |

Harry L. You | | |  |

See “Board of Directors” below for more information about the Director Nominees.

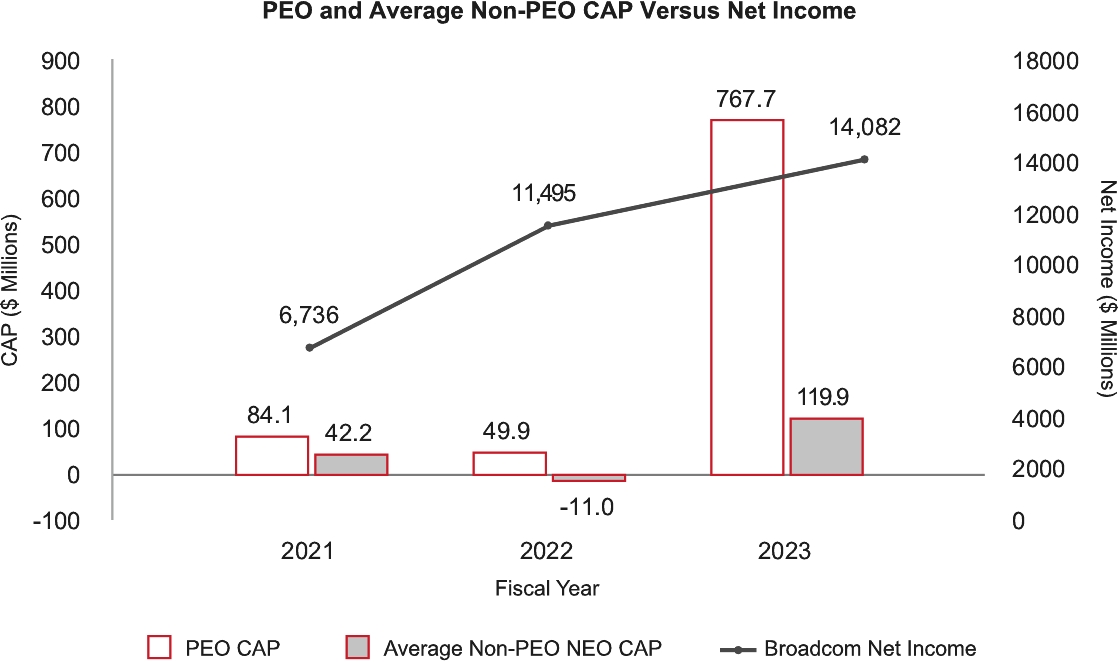

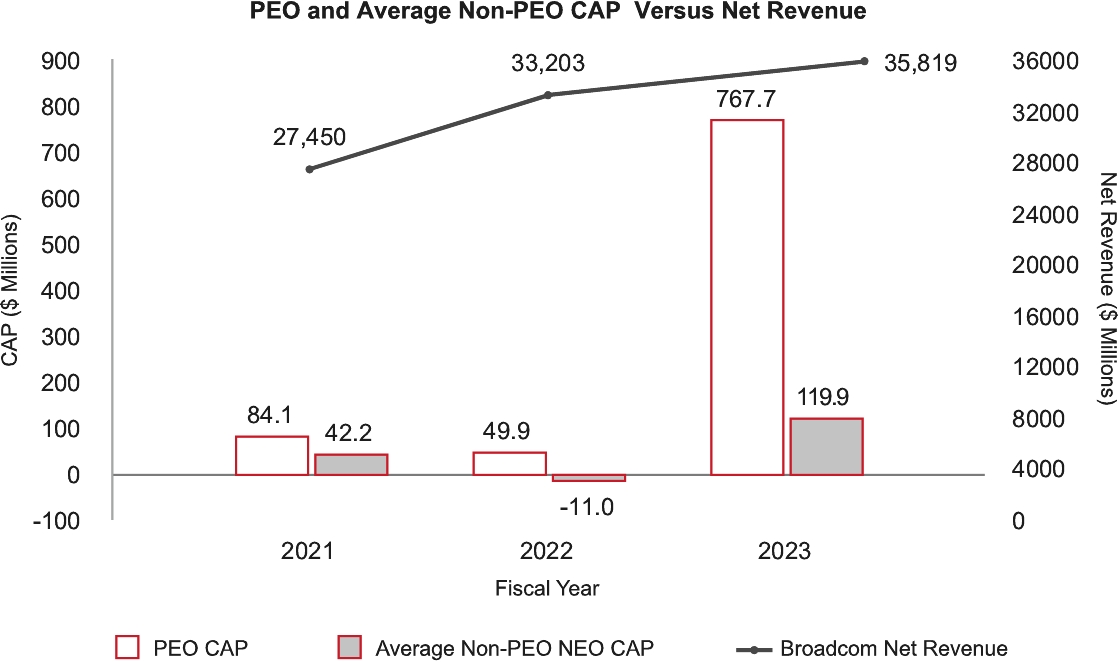

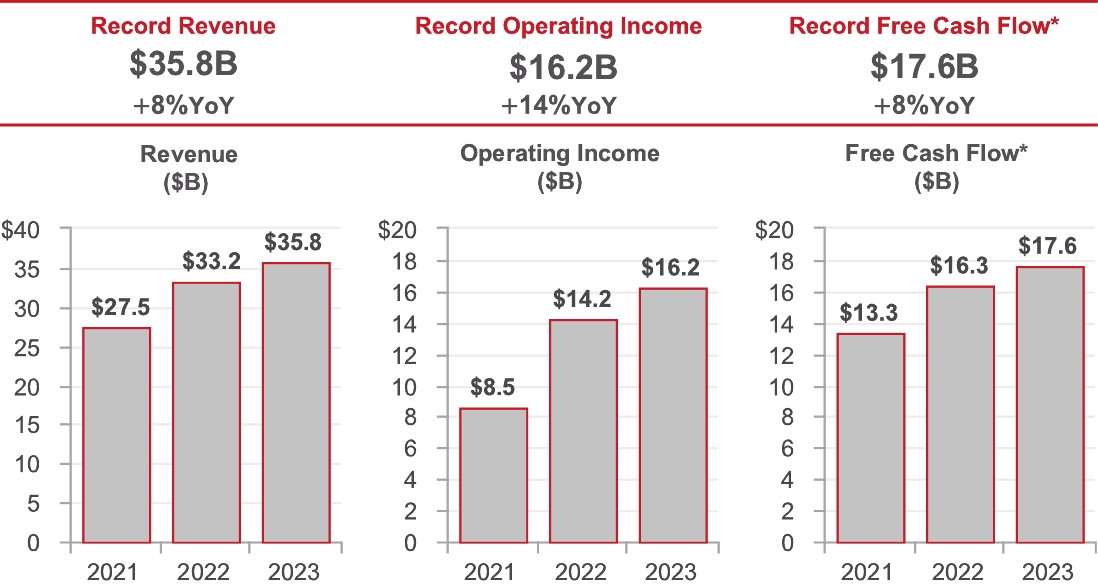

FISCAL 2023 FINANCIAL HIGHLIGHTS

In fiscal 2023, we achieved record revenue of $35.8 billion, operating income of $16.2 billion and free cash flow of $17.6 billion despite the cyclical slowdown in the semiconductor industry. We also returned to our stockholders an aggregate of $13.5 billion via cash dividends and our stock repurchase program.

| | |  | | | 3 |

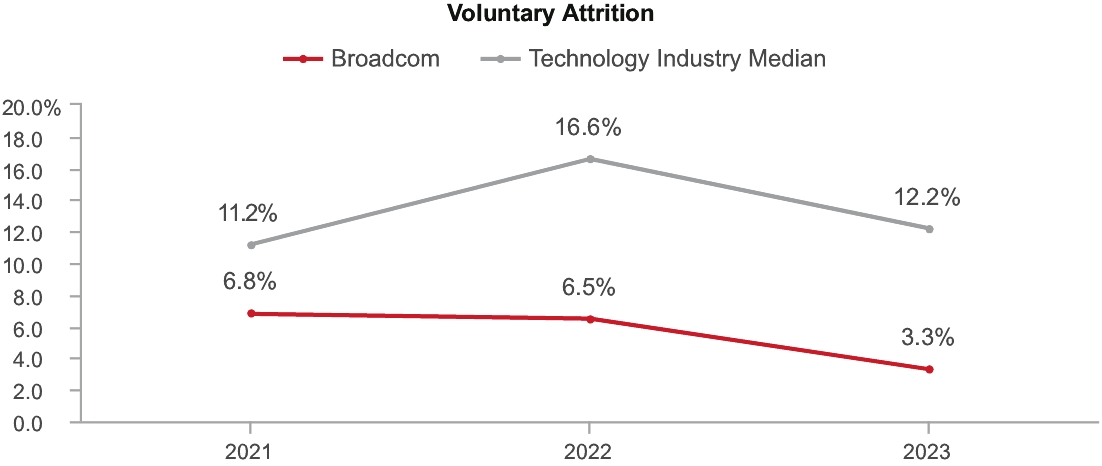

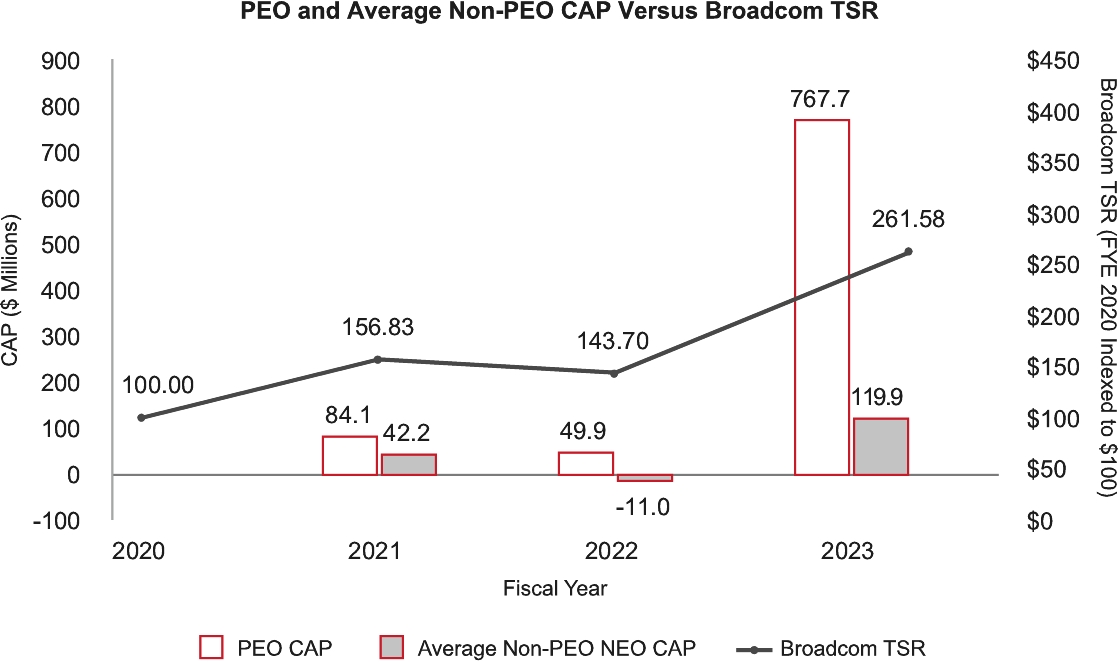

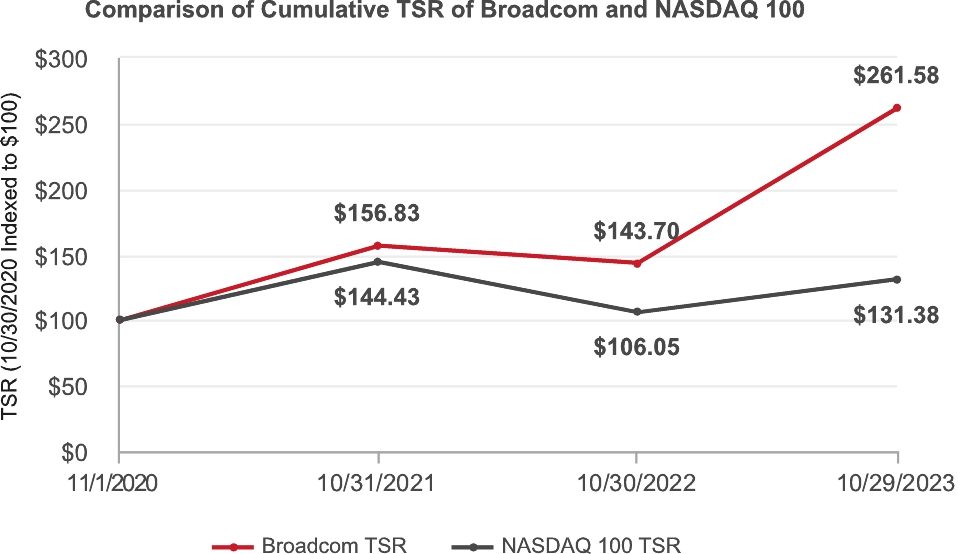

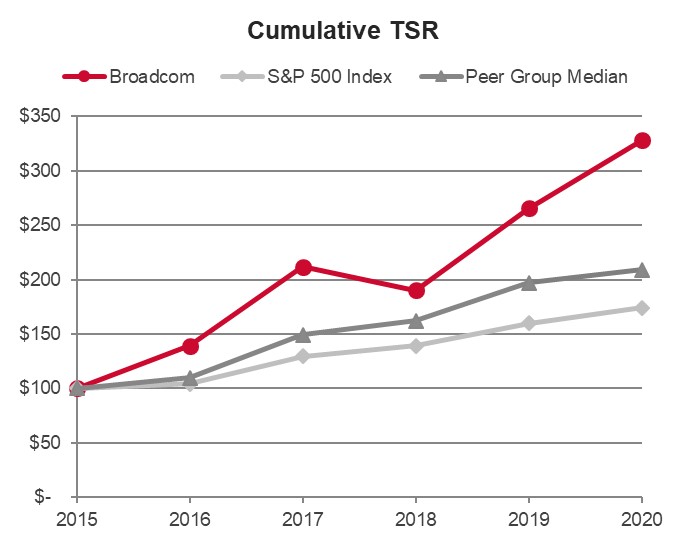

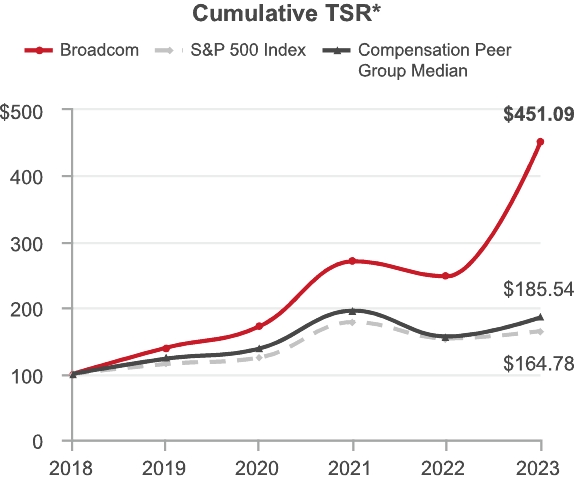

Total Stockholder Return and Return of Capital

Our total stockholder return (“TSR”) continues to significantly outperform the S&P 500 and our compensation peer group. Over the five fiscal year period through 2023, we delivered TSR of 351% and our market capitalization increased from $103.6 billion to $346.0 billion.

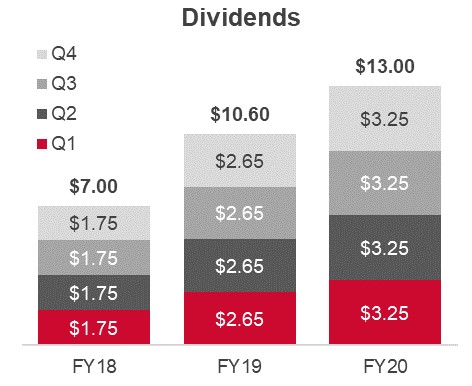

In addition, our strong cash flow in fiscal 2022 enabled us to return an aggregate of $13.5 billion to our stockholders during fiscal 2023, consisting of $7.7 billion in cash dividends and $5.8 billion under our stock repurchase program. We also paid $1.9 billion for the elimination of shares withheld to cover employee withholding taxes due upon the vesting of net settled equity awards. Our strong free cash flow in fiscal 2023 enabled us to increase our quarterly common stock dividend to $5.25 per share in our first quarter of fiscal 2024, an increase of 14% over the quarterly dividend paid in fiscal 2023.

| | |  |

* TSR assumes $100 investment in Broadcom common stock on the last trading day of fiscal 2018 and reinvestment of dividends.

Financial Performance

* See Appendix A for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures.

4 | | |  |

FISCAL 2023 NAMED EXECUTIVE OFFICER COMPENSATION

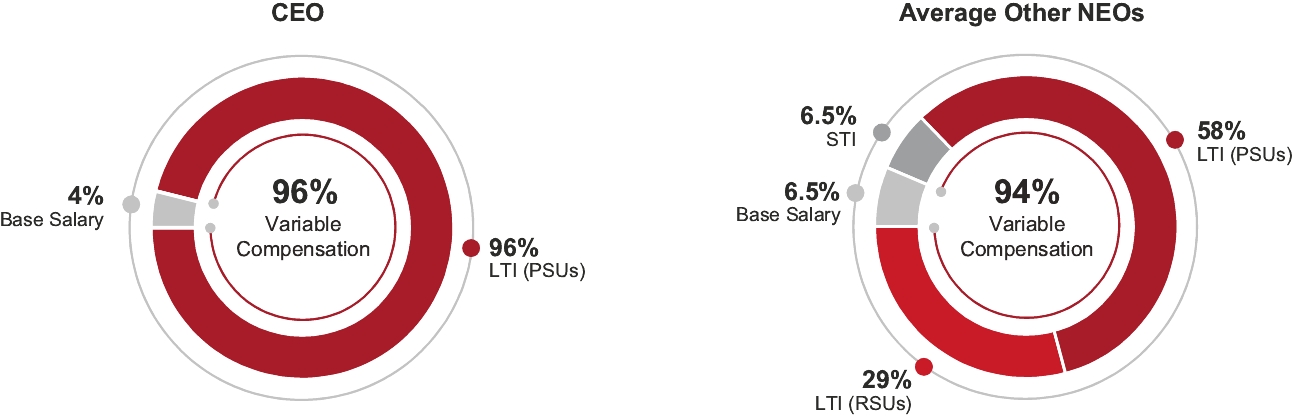

Our executive compensation program is designed to reward our executive officers for producing sustainable growth in sharegrowing and sustaining stockholder value that is consistent with our strategic plan, to align the interests of our executive officers with the interests of our stockholders, and to attract, motivate and retain top talent. The table below highlightscritical talent in a highly competitive talent market.

Consistent with the philosophy and objectives of our key executive compensation program, governance practices.

The short-term incentives (“STI”) through our annual performance cash bonus plan and targetthe long-term incentives (“LTI”) in the form of equityperformance stock unit (“PSU”) awards comprised of service-based restricted stock units (“RSUs”) and performance-based stock units (“PSUs”) based on the fair market value of the awards on the grant date. In Fiscal Year 2019, we granted to our NEOs other than our CEO, multi-yearin fiscal 2023 were subject to challenging and rigorous goals to achieve record financial results and significantly increase stockholder value.

See “Compensation Discussion and Analysis — Elements of Fiscal 2023 Executive Compensation Program — Long-Term Incentive Compensation” below for more information about the equity grants of RSUs and PSUs, which vest on the same basis as if four annual equity grants were made on March 15 each year, beginning in 2019 for four successive years (the “Multi-Year Equity Awards”). The NEO chart below only shows those Multi-Year Equity Awards granted January 15, 2019 that began vesting on March 15, 2020, assuming target performance level attainment. Likewise, as the PSU awardawards granted to our CEO during ourNEOs in fiscal year ended October 29, 2017 (“Fiscal Year 2017”) was a long-term multi-year award, the chart below shows the annualized value of this award, which vests over four years, assuming target performance level attainment. Our NEOs did not receive any equity award grants in Fiscal Year 2020.2023.

| | |  | | | 5 |

We designare committed to strong corporate governance and have designed our corporate governance framework to support the long-term interests of our stockholders, as well as our workforce, customers and compliance with regulatory requirements related to corporate governance. We also closely monitor governance trends and best practices.communities. Some of our key governance practices include the following:

| | | Proxy access | | |  | | | Annual review of Board refreshment and composition | ||

| |||||||||||

Ability to call special meetings by two or more stockholders holding at least 10% of outstanding shares | |||||||||||

| | Separate Chairman and CEO roles, with a Lead Independent Director | |||||||||

| | | No | |  | | | Strong independent Board | |||

| | | No “poison pill” | | |  | | | Annual election of all directors | ||

| | | Annual say-on-pay vote |  | | | Majority vote for directors in uncontested election | ||||

| | | Robust stock ownership guidelines for all executive officers and directors | | |  | | | Independent directors regularly meet in executive session | ||

| | | Anti-hedging and anti-pledging policy for employees and directors |  | | | Active CEO and senior management succession review | ||||

| | Robust stockholder engagement program | | |  | | | Annual Board and committee evaluations | |||

CODE OF ETHICS AND BUSINESS CONDUCT

Our Board has adopted a Code of Ethics and Business Conduct (the “Code of Ethics”) that is applicable to all members of our Board, employees, including our executive officers, and contractors. The Code of Ethics guides us in how we conduct our business and work with each other, and reflects our values, standards and expectations. Any amendments to or waivers given to our executive officers or directors under the Code of Ethics will be disclosed on our website to the extent required under the applicable Securities and Exchange Commission (“SEC”) rules.

A copy of the Code of Ethics is available in the “Investor Center — Corporate Governance — Documents” section of our website or upon request to: Investor Relations, Broadcom Inc., 3421 Hillview Avenue, Palo Alto, California 94304.

CORPORATE GOVERNANCE GUIDELINES

Our Board has adopted the Corporate Governance Guidelines that cover various topics relating to our Board and its activities. A copy of the Corporate Governance Guidelines is available in the “Investor Center — Corporate Governance — Documents” section of our website or upon request to: Investor Relations, Broadcom Inc., 3421 Hillview Avenue, Palo Alto, California 94304. Some of the governance best practices included in the Corporate Governance Guidelines are set forth below.

Protections Against Overboarding

To ensure that our directors are not over-committed and have sufficient time to fulfill their duties and responsibilities on our Board effectively, directors may not serve on more than four other public company boards without prior approval, except that a director who also serves as the chief executive officer of a public company should not serve on more than two public company boards in addition to our Board. The Nominating, Environmental, Social and Governance Committee (the “NESG Committee”) regularly reviews the commitments of our directors, including the number of other public company directorships.

When considering any requests to serve on additional public company boards, our Board, with the NESG Committee, carefully reviews such director’s prior time and attention to our Board and ability to continue to dedicate sufficient time to fulfill the responsibilities required as a member of our Board. Our Board also considers such director’s contributions to our Board, our full Board’s skill and diversity composition and whether such director’s service with the other public company boards will impact service on our Board and the committees on which the director is a member, including if the other public company is a special purpose acquisition company.

6 |  |

Resignation Offered with and understanding the concerns and viewsSignificant Job Change

Any director who retires from or terminates his or her present employment or who materially changes his or her position is required to submit an offer of resignation as a director of our Board. This provides our Board the opportunity to evaluate whether the individual should continue to sit on our Board in light of the director’s new occupational status. Our Board, following review by the NESG Committee, may invite any such director to remain a director if our Board determines that continued access to such director’s knowledge, skills and experience is in the best interests of Broadcom and our stockholders.

Resignation Offered at Age 75

Our Board does not currently believe that a mandatory retirement age for non-employee directors is necessary and that continued service by a particular director may be in the best interests of Broadcom and our stockholders. However, when a non-employee director reaches the age of 75 years, the director is required to offer such director’s resignation to our Board, to be effective as of the next annual meeting of stockholders. This allows our Board to evaluate the composition and needs of our Board and determine whether continued service of such director is in the best interests of Broadcom and our stockholders, taking into consideration that it is an important factor in developing corporate practices that supportto have directors who understand our business, includingoperations, technology, strategy and industry.

STOCK OWNERSHIP GUIDELINES

The Compensation Committee has put in designing an effectiveplace robust stock ownership guidelines for our non-employee directors and executive compensation program. officers as outlined below:

Position | | | Stock Ownership |

Non-Employee Director | | | 5x Annual Cash Retainer |

CEO | | | 6x Base Salary |

Other Executive Officers | | | 3x Base Salary |

Shares owned outright or beneficially owned in a trust, as well as unvested restricted stock unit (“RSU”) awards and earned-but-unvested PSU awards count towards achieving the stock ownership guidelines. Shares subject to outstanding stock options awards do not count towards achieving the stock ownership guidelines.

Our Lead Independent Directornon-employee directors and chairpersonexecutive officers are expected to satisfy the applicable stock ownership guidelines within five years of the Compensation Committee, Mr. Hartenstein, together with members of managementdate on which they become a director or an executive officer and the Investor Relations (“IR”) team, annually participatehold at least such minimum value in our robust stockholder outreach and engagement program.

Based on the closing price of Broadcom common stock on the Record Date, all of our non-employee directors and executive officers have met the level of ownership in discussionsour stock ownership guidelines.

ANTI-HEDGING AND TRADING RESTRICTIONS

Our insider trading policy prohibits our directors and employees, including our executive officers, from hedging or pledging our securities, making short sales or trading in derivative securities related to our securities.

CEO AND SENIOR MANAGEMENT SUCCESSION PLANNING

Our Board is actively engaged and involved in CEO and senior management succession planning. Our Board discusses CEO succession planning at least bi-annually. Our Board has developed an interim contingency and a longer-term CEO succession plan. The interim contingency plan would utilize internal candidates and become effective in the event our CEO unexpectedly becomes unable to perform his duties, in order to minimize disruption to the business and preserve operational continuity. The longer-term CEO succession plan is currently focused on the development of internal candidates, as well as on maintaining business and operational continuity. In addition, our Board, with our largest stockholders on matters such as our executiveCEO and Vice President of Human Resources, regularly discusses senior management succession plan, executive compensation programplanning and equity compensation strategy.

| | |  | | | 7 |

CORPORATE SOCIAL RESPONSIBILITY

Our Board, through the NESG Committee, oversees our environment, climate, diversity and inclusion, governance and human rights in the supply chain matters, including our corporate social responsibility and sustainability program and initiatives. The NESG Committee receives quarterly updates from management on these matters and regularly updates our Board. Our Board also reviews our annual Environmental, Social and Governance Report.

In February 2024, we produced in February 2021published our first report on environment/climate,Environmental, Social and Governance Report for fiscal 2023 (the “Report”). In the Report, we discuss our fiscal 2023 corporate social responsibility and governance matterssustainability program and initiatives, including our products that discusseshelp our responsible business and procurement practices, as well ascustomers with sustainability, our human rights program within our supply chain, our talented and dedicated workforce. Our Environmental, Socialworkforce and Governance (“ESG”)our environmental impact. We also disclosed in the Report our progress in reducing our Scope 1 and Scope 2 greenhouse gas emissions in line with the UN Paris Agreement and Science Based Targets Initiative goal to limit global warming to 1.5º Celsius above pre-industrial levels.

We prepared the Report leveraging the Global Reporting Initiative (GRI) Sustainability Reporting Standards (core option), the Sustainability Accounting Standards Board (SASB) Semiconductors and Software & IT Services Industry Standards and the framework developed by the Task Force on Climate-Related Financial Disclosures (TCFD).

Additional information about our corporate social responsibility and sustainability program and initiatives is available in the Report, which is located in the Corporate Citizenship and the Investor Center sections of our website. The Report and our website are not part of or incorporated by reference into the Proxy Statement.

STOCKHOLDER ENGAGEMENT

We increased our businessengagement with our stockholders in fiscal 2023 and specifically those factors discussed from timemet with our stockholders after the 2023 annual meeting due to timethe level of support the Say-on-Pay proposal received at the 2023 annual meeting. More information about our engagement with our stockholders and our Board’s response to our stockholders’ feedback is provided below in “Stockholder Engagement.”

We also continue to engage with our public reports filedstockholders on the progress of our corporate social responsibility and sustainability program and initiatives.

STOCKHOLDER COMMUNICATIONS WITH OUR BOARD

You may communicate with our Board at the Securities and Exchange Commission (“SEC”), such as those discussed under the heading, “Risk Factors,” in our 2020 Annual Report and as may be updated in our subsequent SEC filings.

following address:

Board of Directors

Broadcom Inc.

c/o Chief Legal and Corporate Affairs Officer

3421 Hillview Avenue

Palo Alto, California 94304

Communications are distributed to our Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded, but will be made available to any director upon request.

8 | | |  |

Our Board oversees the conduct of our business by our senior management and risk management, provides guidance on our strategic and business planning, processes, is principally responsible for the succession planning for our key executives, including our CEO and senior management, and ensures that the long-term interests of stockholders are being served.

BOARD MEMBERSHIP

Our Board held eight meetings during Fiscal Year 2020. Each director attended at least 75%is currently comprised of ten directors: Diane M. Bryant, Gayla J. Delly, Raul J. Fernandez, Kenneth Y. Hao, Eddy W. Hartenstein, Check Kian Low, Justine F. Page, Henry Samueli, Ph.D., Hock E. Tan and Harry L. You. Mr. Hao was appointed to our Board in February 2024.

Mr. Fernandez is not standing for re-election and will serve on our Board until the aggregate number of meetingsAnnual Meeting. At the Annual Meeting, the size of our Board will be reduced to nine directors.

DIRECTOR INDEPENDENCE

Our Board annually reviews the independence of each director and all committeesnominee and considers whether such individual has a material relationship with Broadcom that could compromise their ability to exercise independent judgment in carrying out their responsibilities. For the purpose of assessing a director’s independence, our Board reviewed transactions and relationships between Broadcom and an entity where a director or nominee serves as a director, executive officer and/or is the beneficial owner, directly or indirectly, of such entity, or where a director or nominee for director serves on a non-employee advisory board of or in a non-employee advisory capacity to such an entity.

Our Board has determined that Dr. Samueli, Mses. Bryant, Delly and Page, and Messrs. Hao, Hartenstein, Low and You, representing eight of our nine director nominees, are currently “independent” directors. Mr. Tan, who serves as our President and CEO, is not deemed an “independent” director. Our Board on which he or she served during Fiscal Year 2020. Our independent directors met at regularly scheduled executive sessions without management present. Our Corporate Governance Guidelines providehas determined that eachMr. Fernandez, who will serve as a director until the Annual Meeting, is expected to attend the annual meetings of our stockholders. All of our directors attended the annual meeting in March 2020.also an “independent” director.

Our Board currently believes that Broadcom and itsour stockholders are best served by a Board leadership structure in which the roles of the CEO and the Chairman of the Board are held by different individuals, and that there be a Lead Independent Director if the Chairman is not independent. Under this structure, our CEO is generally responsible for setting theBroadcom’s strategic direction of Broadcom and for the day-to-day management of our operations. The independent Chairman and/or the Lead Independent Director, as applicable, provides strong independent leadership to assist our Board in fulfilling its oversight role of management and our risk management practices, approves the agenda for Board meetings and presides over Board meetings and over the meetings of our independent directors in executive session. Our Board annually reviews its leadership structure to determine whether it continues to best serve Broadcom and itsour stockholders. Currently, Mr. Tan serves as our President and CEO, Dr. Samueli serves as our independent Chairman of the Board and Mr. Hartenstein serves as our Lead Independent Director. Upon his election as Chairman of the Board in 2018, Dr. Samueli resigned from his position as our Chief Technical Officer.

In accordance with ourthe Corporate Governance Guidelines, our Board seeks individuals to serve as directors who have the highest personal and professional integrity, who havestrength of character, demonstrated exceptional ability and judgment, and who are effective in providing the diversity of skills, experience and background soundness of judgment appropriate for the business and operations of Broadcom, and serving the long-term interests of our stockholders.Broadcom.

When evaluating director candidates, the Nominating, Environmental, Social & GovernanceNESG Committee (“NESG Committee”) seeks to ensure that our Board has the requisite skills, experience and expertise, and that our Board consist of persons with appropriately diverse and independent backgrounds.

The NESG Committee will considerconsiders all aspects of a candidate’s qualifications in the context of the needs of Broadcom, including:

| | |  | | | 9 |

experience as a board member of another public company;company

independence from management

The NESG Committee will consider nominee recommendations from its members, other Board members and members of our management, as well as nominees recommended by our stockholders. The NESG Committee has from time to time also engaged third-party search firms to assist in identifying and evaluating possible candidates.

See “Other Information –— Stockholder Proposals and Director Nominations for the 20222025 Annual Meeting” below for information on the requirements for director nominations, including nominations using proxy access.

DIRECTOR ATTENDANCE AND MEETINGS

The Corporate Governance Guidelines provide that each director is expected to attend all meetings of our Board and of each committee on which the director is a member and the annual meetings of stockholders. Our Board held nine meetings during fiscal 2023 and our independent directors met at regularly scheduled executive sessions without management present. Each director attended at least 75% of the aggregate number of meetings of our Board and all committees of our Board on which the director served during fiscal 2023. Eight of our nine directors then serving on our Board attended the 2023 annual meeting.

BOARD EVALUATIONS

Our Board is committed to reviewing its performance through an annual evaluation process, which is overseen by the NESG Committee. Through the evaluations, our directors provide feedback on our Board and its committees and assess its processes and overall effectiveness. The Chairman of the Board and the Lead Independent Director report the results to our full Board and the Chairs of each committee report the results to their respective committees.

BOARD RISK OVERSIGHT

Our Board believes that evaluating Broadcom’s most critical risks is one of its most important areas of oversight. Our Board regularly reviews and discusses with management risks related to operations, liquidity, credit, cybersecurity, climate, compensation programs, workforce retention and senior management succession.

10 | | |  |

In addition, each committee is responsible for the oversight of specific areas of risk and reports regularly to our Board Committeeson matters relating to those risks. Management reports, at least annually, on our risks and risk management practices to the relevant committees and the full Board.

Committee | | | Primary Areas of Risk Oversight | |||

Audit | | | • | | | Oversee financial reporting process, accounting policies and internal controls |

| | | • | | | Evaluate risks related to financial reporting, accounting, auditing, tax and fraud | |

| | | • | | | Evaluate exposures and risks related to cybersecurity, data privacy and information technology and its controls, including cybersecurity performance and monitoring, assessing and reporting such exposure | |

| | | • | | | Review and approve related party transactions | |

Compensation | | | • | | | Oversee compensation plans, programs and policies |

| | | • | | | Evaluate the relationship between risk management policies and practices, business strategy and compensation of executive officers and other executives | |

| | | • | | | Evaluate and provide input on CEO and senior management succession planning | |

NESG | | | • | | | Review and evaluate the corporate governance framework, including governance guidelines and policies |

| | | • | | | Evaluate the structure and composition of our Board and committees, including succession planning, diversity and related policies and procedures | |

| | | • | | | Oversee the corporate social responsibility and sustainability program and initiatives, including matters related to the environment, climate, diversity and inclusion, governance and human rights in the supply chain | |

Cybersecurity Risk Management

Our Board is actively involved in overseeing our cybersecurity, data privacy and information technology risk management. Our management, including our Chief Information Officer, in consultation with our Chief Information Security Officer, reviews with the Audit Committee at least quarterly our cybersecurity, data privacy and information technology security policies, practices and protective measures, current and projected threats to our data privacy and information security, cybersecurity incidents and related risks. Our Chief Information Officer also provides the Audit Committee at least quarterly an update on our enterprise security program that includes procedures and policies for testing vulnerabilities, responding to cybersecurity threats and providing a variety of cybersecurity, data privacy and incident response trainings to our employees. The Audit Committee and management also update our Board at least quarterly on our cybersecurity performance and risk profile and the effectiveness of our cybersecurity processes.

Compensation Risk Assessment

The Compensation Committee, in consultation with Meridian Compensation Partners, LLC (“Meridian”), conducts an annual review of our compensation policies and practices for our employees to assess the risks associated with such policies and practices. The Compensation Committee considered risk-mitigating factors in its review, such as our compensation policies and practices that provide a balance of short-term and long-term goals and awards and a mix of cash and equity components in the annual total compensation (as described below in “Compensation Discussion and Analysis” and “Executive Compensation”). The Compensation Committee also considered stock ownership guidelines, hedging and pledging prohibitions and its own oversight process which consists of independent directors.

BOARD COMMITTEES

Our Board has anthe following committees: Audit Committee, a Compensation Committee, a NESG Committee and an Executive Committee. Each of theThe Audit Committee, the Compensation Committee and the NESG Committee operateseach operate under a charter that satisfies the applicable standardsrules of the SEC and Nasdaq.the Nasdaq Stock Market (“Nasdaq”) listing standards. The charters for all four committees are available in the “Investor Center—Center — Corporate Governance—Governance — Documents” section of our website (http://investors.broadcom.com).website. Stockholders may also request a copy from Investor Relations, Broadcom Inc., 1320 Ridder Park Drive, San Jose,3421 Hillview Avenue, Palo Alto, California 95131.94304.

| | |  | | | 11 |

The current members and chairs of the committees are provided below.

| | | Committees | ||||||||||

Name | | | Audit | | | Compensation | | | NESG | | | Executive |

Diane M. Bryant | | | | |  | | | | | |||

Gayla J. Delly | | |  | | | | |  | | | ||

Raul J. Fernandez | | |  | | | | |  | | | ||

Kenneth Y. Hao(1) | | | | | | | | | ||||

Eddy W. Hartenstein (Lead Independent Director) | | | | |  | | |  | | |  | |

Check Kian Low | | | | |  | | |  | | | ||

Justine F. Page | | |  | | | | | | |  | ||

Henry Samueli, Ph.D. (Chairman of the Board) | | | | | | | | |  | |||

Hock E. Tan (President & CEO) | | | | | | | | |  | |||

Harry L. You | | |  | | |  | | | | |  | |

| | | Member | | |  | | | Chair |

| (1) | Mr. Hao has not been appointed to any committees. |

Resignation Offered at Age 75

Our Board does not currently believe that a mandatory retirement age for non-employee directors is necessary and that continued service by a particular director may be in the best interests of Broadcom and our stockholders. However, when a non-employee director reaches the age of 75 years, the director is required to offer such director’s resignation to our Board, to be effective as of the next annual meeting of stockholders. This allows our Board to evaluate the composition and needs of our Board and determine whether continued service of such director is in the best interests of Broadcom and our stockholders, taking into consideration that it is important to have directors who understand our business, operations, technology, strategy and industry.

STOCK OWNERSHIP GUIDELINES

The Compensation Committee has put in place robust stock ownership guidelines for our non-employee directors and executive officers as outlined below:

Position | | | Stock Ownership |

Non-Employee Director | | | 5x Annual Cash Retainer |

CEO | | | 6x Base Salary |

Other Executive Officers | | | 3x Base Salary |

Shares owned outright or beneficially owned in a trust, as well as unvested restricted stock unit (“RSU”) awards and earned-but-unvested PSU awards count towards achieving the stock ownership guidelines. Shares subject to outstanding stock options awards do not count towards achieving the stock ownership guidelines.

Our non-employee directors and executive officers are expected to satisfy the applicable stock ownership guidelines within five years of the date on which they become a director or an executive officer and hold at least such minimum value in shares of common stock while they remain a director or an executive officer.

Based on the closing price of Broadcom common stock on the Record Date, all of our non-employee directors and executive officers have met the level of ownership in our stock ownership guidelines.

ANTI-HEDGING AND TRADING RESTRICTIONS

Our insider trading policy prohibits our directors and employees, including our executive officers, from hedging or pledging our securities, making short sales or trading in derivative securities related to our securities.

CEO AND SENIOR MANAGEMENT SUCCESSION PLANNING

Our Board is actively engaged and involved in CEO and senior management succession planning. Our Board discusses CEO succession planning at least bi-annually. Our Board has developed an interim contingency and a longer-term CEO succession plan. The interim contingency plan would utilize internal candidates and become effective in the event our CEO unexpectedly becomes unable to perform his duties, in order to minimize disruption to the business and preserve operational continuity. The longer-term CEO succession plan is currently focused on the development of internal candidates, as well as on maintaining business and operational continuity. In addition, our Board, with our CEO and Vice President of Human Resources, regularly discusses senior management succession planning and reviews the composition of senior management. Our Board reviews the qualifications and experience of the potential successors and the development priorities and achievements of the potential successors. Our Board also engages with the audit committee independence requirements underpotential internal successors at least annually at Board meetings and in less formal settings.

| | |  | | | 7 |

CORPORATE SOCIAL RESPONSIBILITY

Our Board, through the applicable rulesNESG Committee, oversees our environment, climate, diversity and regulationsinclusion, governance and human rights in the supply chain matters, including our corporate social responsibility and sustainability program and initiatives. The NESG Committee receives quarterly updates from management on these matters and regularly updates our Board. Our Board also reviews our annual Environmental, Social and Governance Report.

In February 2024, we published our Environmental, Social and Governance Report for fiscal 2023 (the “Report”). In the Report, we discuss our fiscal 2023 corporate social responsibility and sustainability program and initiatives, including our products that help our customers with sustainability, our human rights program within our supply chain, our talented and dedicated workforce and our environmental impact. We also disclosed in the Report our progress in reducing our Scope 1 and Scope 2 greenhouse gas emissions in line with the UN Paris Agreement and Science Based Targets Initiative goal to limit global warming to 1.5º Celsius above pre-industrial levels.

We prepared the Report leveraging the Global Reporting Initiative (GRI) Sustainability Reporting Standards (core option), the Sustainability Accounting Standards Board (SASB) Semiconductors and Software & IT Services Industry Standards and the framework developed by the Task Force on Climate-Related Financial Disclosures (TCFD).

Additional information about our corporate social responsibility and sustainability program and initiatives is in the Report, which is located in the Corporate Citizenship and the Investor Center sections of our website. The Report and our website are not part of or incorporated by reference into the Proxy Statement.

STOCKHOLDER ENGAGEMENT

Our Board values open and ongoing engagement with our stockholders to develop a better understanding of our stockholders’ views on various matters, including executive compensation, succession planning, risk oversight and sustainability. Our Compensation Committee Chair, together with representatives from the Legal and Human Resources teams, annually engage with our stockholders in a robust stockholder engagement program.

Prior to the 2023 annual meeting, we contacted our stockholders representing over 54% of our common stock outstanding and engaged with stockholders representing 49% of our common stock outstanding. Our Chairman of the SECBoard, Lead Independent Director and Nasdaq. Compensation Committee Chair, along with representatives from the Legal and Human Resources teams, participated in these meetings. A variety of topics, including risk management and succession planning, were discussed in these meetings; however, the primary topic was executive compensation.

We increased our engagement with our stockholders in fiscal 2023 and met with our stockholders after the 2023 annual meeting due to the level of support the Say-on-Pay proposal received at the 2023 annual meeting. More information about our engagement with our stockholders and our Board’s response to our stockholders’ feedback is provided below in “Stockholder Engagement.”

We also continue to engage with our stockholders on the progress of our corporate social responsibility and sustainability program and initiatives.

STOCKHOLDER COMMUNICATIONS WITH OUR BOARD

You may communicate with our Board at the following address:

Board of Directors

Broadcom Inc.

c/o Chief Legal and Corporate Affairs Officer

3421 Hillview Avenue

Palo Alto, California 94304

Communications are distributed to our Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded, but will be made available to any director upon request.

8 | | |  |

Our Board oversees the conduct of our business by senior management and risk management, provides guidance on strategic and business planning, is principally responsible for succession planning for our CEO and senior management, and ensures that the long-term interests of stockholders are being served.

BOARD MEMBERSHIP

Our Board is currently comprised of ten directors: Diane M. Bryant, Gayla J. Delly, Raul J. Fernandez, Kenneth Y. Hao, Eddy W. Hartenstein, Check Kian Low, Justine F. Page, Henry Samueli, Ph.D., Hock E. Tan and Harry L. You. Mr. Hao was appointed to our Board in February 2024.

Mr. Fernandez is not standing for re-election and will serve on our Board until the Annual Meeting. At the Annual Meeting, the size of our Board will be reduced to nine directors.

DIRECTOR INDEPENDENCE

Our Board annually reviews the independence of each director and nominee and considers whether such individual has a material relationship with Broadcom that could compromise their ability to exercise independent judgment in carrying out their responsibilities. For the purpose of assessing a director’s independence, our Board reviewed transactions and relationships between Broadcom and an entity where a director or nominee serves as a director, executive officer and/or is the beneficial owner, directly or indirectly, of such entity, or where a director or nominee for director serves on a non-employee advisory board of or in a non-employee advisory capacity to such an entity.

Our Board has determined that each ofDr. Samueli, Mses. Bryant, Delly and Page, and Messrs. Hao, Hartenstein, Low and You, representing eight of our nine director nominees, are currently “independent” directors. Mr. YouTan, who serves as our President and CEO, is not deemed an audit committee financial expert under“independent” director. Our Board has determined that Mr. Fernandez, who will serve as a director until the Annual Meeting, is also an “independent” director.

BOARD LEADERSHIP STRUCTURE

Our Board currently believes that Broadcom and our stockholders are best served by a Board leadership structure in which the roles of the CEO and the Chairman of the Board are held by different individuals, and that there be a Lead Independent Director if the Chairman is not independent. Under this structure, our CEO is generally responsible for setting Broadcom’s strategic direction and for the day-to-day management of our operations. The independent Chairman and/or the Lead Independent Director, as applicable, SEC rulesprovides strong independent leadership to assist our Board in fulfilling its oversight role of management and our risk management practices, approves the agenda for Board meetings and presides over Board meetings and over the meetings of our independent directors in executive session. Our Board annually reviews its leadership structure to determine whether it continues to best serve Broadcom and our stockholders. Currently, Mr. Tan serves as our President and CEO, Dr. Samueli serves as our independent Chairman of the Board and Mr. Hartenstein serves as our Lead Independent Director. Our Board has decided to continue the current leadership structure and division of responsibilities.

DIRECTOR NOMINATIONS

In accordance with the Corporate Governance Guidelines, our Board seeks individuals to serve as directors who have the highest personal and professional integrity, strength of character, demonstrated exceptional ability and judgment, and diversity of skills, experience and background appropriate for the business and operations of Broadcom.

When evaluating director candidates, the NESG Committee seeks to ensure that our Board has the requisite financial sophistication requiredskills, experience and expertise, and that our Board consist of persons with appropriately diverse and independent backgrounds.

The NESG Committee considers all aspects of a candidate’s qualifications in the context of the needs of Broadcom, including:

personal and professional integrity, ethics and values

experience as an officer in corporate management

experience and expertise in our industries and international business, and familiarity with Broadcom

| | |  | | | 9 |

experience as a board member of another public company

practical and mature business judgment

diversity of background and perspective (including age, ethnicity, race, experience, gender and education)

Board size and composition and the extent to which a candidate would fill a present need on our Board

other ongoing commitments and obligations of the candidate

independence from management

The NESG Committee will consider nominee recommendations from its members, other Board members and members of our management, as well as nominees recommended by applicable Nasdaq rules.our stockholders. The NESG Committee has from time to time also engaged third-party search firms to assist in identifying and evaluating possible candidates.

DIRECTOR ATTENDANCE AND MEETINGS

The Corporate Governance Guidelines provide that each director is expected to attend all meetings of our Board and of each committee on which the director is a member and the annual meetings of stockholders. Our Board held nine meetings during fiscal 2023 and our independent directors met at regularly scheduled executive sessions without management present. Each director attended at least 75% of the aggregate number of meetings of our Board and all committees of our Board on which the director served during fiscal 2023. Eight of our nine directors then serving on our Board attended the 2023 annual meeting.

BOARD EVALUATIONS

Our Board is committed to reviewing its performance through an annual evaluation process, which is overseen by the NESG Committee. Through the evaluations, our directors provide feedback on our Board and its committees and assess its processes and overall effectiveness. The Chairman of the Board and the Lead Independent Director report the results to our full Board and the Chairs of each committee report the results to their respective committees.

BOARD RISK OVERSIGHT

Our Board believes that evaluating Broadcom’s most critical risks is one of its most important areas of oversight. Our Board regularly reviews and discusses with management risks related to operations, liquidity, credit, cybersecurity, climate, compensation programs, workforce retention and senior management succession.

10 | | |  |

In addition, each committee is responsible for the oversight of specific areas of risk and reports regularly to our Board on matters relating to those risks. Management reports, at least annually, on our risks and risk management practices to the relevant committees and the full Board.

Committee | | | |||||||

Primary | |||||||||

| Areas of Risk Oversight | |||||||||

Audit | | | • | | | Oversee | |||

| | | • | | | Evaluate risks related to financial reporting, accounting, auditing, tax and | ||||

| | | • | | | |||||

| | | • | | | Review and | ||||

Compensation | | | • | | | |||

| | | • | | | ||||

| | | • | | | Evaluate and provide input on CEO and | |||

NESG | | | • | | | Review and evaluate the corporate governance framework, including governance guidelines and policies | ||

| | | • | | | Evaluate the structure and composition of our Board | |||

| | • | | | Oversee the corporate social responsibility and sustainability program and initiatives, including matters related to the environment, climate, diversity and inclusion, governance and human rights in the supply chain | ||||

Cybersecurity Risk Management

Our Board is actively involved in overseeing our cybersecurity, data privacy and information technology risk management. Our management, conducted itsincluding our Chief Information Officer, in consultation with our Chief Information Security Officer, reviews with the Audit Committee at least quarterly our cybersecurity, data privacy and information technology security policies, practices and protective measures, current and projected threats to our data privacy and information security, cybersecurity incidents and related risks. Our Chief Information Officer also provides the Audit Committee at least quarterly an update on our enterprise security program that includes procedures and policies for testing vulnerabilities, responding to cybersecurity threats and providing a variety of cybersecurity, data privacy and incident response trainings to our employees. The Audit Committee and management also update our Board at least quarterly on our cybersecurity performance and risk profile and the effectiveness of our cybersecurity processes.

Compensation Risk Assessment

The Compensation Committee, in consultation with Meridian Compensation Partners, LLC (“Meridian”), conducts an annual review of our compensation policies and practices for our employees to assess the risks associated with such policies and practices. The Compensation Committee considered risk-mitigating factors in its review, such as they relate to our risk management, and reported their findings in January 2021 to the Compensation Committee. Our compensation policies and practices (described in more detail under“Compensation Discussion and Analysis” and “Executive Compensation”below)that provide a balance short-of short-term and long-term goals and awards as well as theand a mix of the cash and equity components. Based upon this review,components in the annual total compensation (as described below in “Compensation Discussion and Analysis” and “Executive Compensation”). The Compensation Committee believesalso considered stock ownership guidelines, hedging and pledging prohibitions and its own oversight process which consists of independent directors.

BOARD COMMITTEES

Our Board has the elements of our compensation programs do not encourage unnecessary or excessive risk-taking, and are not reasonably likely to have a material adverse effect on Broadcom in the future.

| | |  | | | 11 |

The current members and chairs of the committees are provided below.

| | | Committees | ||||||||||

Name | Audit | | | Compensation | | | NESG | | | Executive | ||

Diane M. Bryant | | | | |  | | | | | |||

Gayla J. Delly | | |  | | | | |  | | | ||

Raul J. Fernandez | | |  | | | | |  | | | ||

Kenneth Y. Hao(1) | | | | | | | | | ||||

Eddy W. Hartenstein | | | | |  | | |  | | |  | |

Check Kian Low | | | | |  | |||||||

| | |  | | | ||||||||

Justine F. Page | ||||||||||||

| |  | | | | | | |  | ||||

Henry Samueli, Ph.D. | | | | | | | | |  | |||

Hock E. Tan (President & CEO) | | | | | | | |  | ||||

Harry L. You | | |  | | |  | | | | |  | |

| | | Member | | |  | | | Chair |

| (1) | Mr. Hao has not been appointed to any committees. |

Resignation Offered with Significant Job Change

Any director who retires from or terminates his or her present employment or who materially changes his or her position is required to submit an offer of resignation as a director of our Board. This provides our Board the opportunity to evaluate whether the individual should continue to sit on our Board in light of his or herthe director’s new occupational status. Our Board, following review by the NESG Committee, may invite any such director to remain a director if our Board determines that continued access to such director’s knowledge, skills and experience is in the best interests of Broadcom and our stockholders.

Resignation Offered at Age 75

Our Board does not currently believe that a mandatory retirement age for non-employee directors is necessary and that continued service by a particular director may be in the best interests of Broadcom and our stockholders. However, when a non-employee director reaches the age of 75 years, the director is required to offer his or hersuch director’s resignation to our Board, to be effective as of the next annual meeting of stockholders. This allows our Board to evaluate the composition and needs of our Board and determine whether continued service of such director is in the best interests of Broadcom and our stockholders.stockholders, taking into consideration that it is important to have directors who understand our business, operations, technology, strategy and industry.

Position | | | Stock Ownership | ||

Non-Employee Director | | 5x Annual Cash Retainer | |||

CEO | | 6x Base Salary | |||

Other Executive Officers | |||||

| | 3x | ||||

Our non-employee directors and executive officers including our CEO, are expected to satisfy the applicable stock ownership guidelines within five years of the date on which they become a director or an executive officer and to hold at least such minimum value in shares of common stock for so long as he or she remainswhile they remain a director or an executive officer.

Our insider trading policy prohibits our directors and employees, (including, without limitation,including our executive officers)officers, from hedging or pledging our securities, making short sales or trading in derivative securities related to our securities.

CEO AND SENIOR MANAGEMENT SUCCESSION PLANNING

involved in CEO and senior management succession planning. Our Board discusses CEO succession planning at least bi-annually. Our Board has developed an interim contingency and a longer-term CEO succession plan. The current membersinterim contingency plan would utilize internal candidates and become effective in the event our CEO unexpectedly becomes unable to perform his duties, in order to minimize disruption to the business and preserve operational continuity. The longer-term CEO succession plan is currently focused on the development of internal candidates, as well as on maintaining business and operational continuity. In addition, our Board, with our CEO and Vice President of Human Resources, regularly discusses senior management succession planning and reviews the composition of senior management. Our Board reviews the qualifications and experience of the Compensation Committee, Ms. Bryantpotential successors and Messrs. Hartenstein, Lowthe development priorities and You, are not,achievements of the potential successors. Our Board also engages with the potential internal successors at least annually at Board meetings and have never been, officers or employees of Broadcom. During Fiscal Year 2020, none of our executive officers served on the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or the Compensation Committee.in less formal settings.

| | |  | | | 7 |

CORPORATE SOCIAL RESPONSIBILITY

Our Board, through the NESG Committee, oversees our environment, climate, diversity and regularly reports to our Board on environment/climate, social (diversityinclusion, governance and inclusion) and governancehuman rights in the supply chain matters, including with respect to Broadcom’sour corporate social responsibility and sustainability program and initiatives. The NESG Committee receives quarterly updates from management on these matters and regularly updates our Board. Our Board also reviews our annual Environmental, Social and Governance Report.

In recognition ofFebruary 2024, we published our Environmental, Social and Governance Report for fiscal 2023 (the “Report”). In the increased importance ofReport, we discuss our fiscal 2023 corporate social responsibility and sustainability for Broadcom’s continued business success,program and initiatives, including our products that help our customers with sustainability, our human rights program within our supply chain, our talented and dedicated workforce and our environmental impact. We also disclosed in the Report our progress in reducing our Scope 1 and Scope 2 greenhouse gas emissions in line with the UN Paris Agreement and Science Based Targets Initiative goal to limit global warming to 1.5º Celsius above pre-industrial levels.

We prepared the Report leveraging the Global Reporting Initiative (GRI) Sustainability Reporting Standards (core option), the Sustainability Accounting Standards Board changed(SASB) Semiconductors and Software & IT Services Industry Standards and the name offramework developed by the “Nominating and Corporate Governance Committee” to the “Nominating, Environmental, Social and Governance Committee.”Task Force on Climate-Related Financial Disclosures (TCFD).

Prior to the 2023 annual meeting, we contacted our stockholders representing over 54% of our common stock outstanding and engaged with stockholders representing 49% of our common stock outstanding. Our Chairman of the Board, Lead Independent Director and Compensation Committee Chair, along with representatives from the Legal and Human Resources teams, participated in these meetings. A variety of topics, including risk management and succession planning, were discussed in these meetings; however, the primary topic was executive compensation.

We increased our engagement with our stockholders in fiscal 2023 and met with our stockholders after the 2023 annual meeting due to the level of support the Say-on-Pay proposal received at the 2023 annual meeting. More information about our engagement with our stockholders and our Board’s response to our stockholders’ feedback is provided below in “Stockholder Engagement.”

We also continue to engage with our stockholders on the progress of our corporate social responsibility and sustainability program and initiatives.

STOCKHOLDER COMMUNICATIONS WITH OUR BOARD

You may communicate with our Board at the following address:

Broadcom Inc.

c/o Chief Legal and Corporate Affairs Officer

Communications are distributed to our Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded, but will be made available to any director upon request.

8 | | |  |

Our Board oversees the conduct of our business by senior management and risk management, provides guidance on strategic and business planning, is principally responsible for succession planning for our CEO and senior management, and ensures that the long-term interests of stockholders are being served.

BOARD MEMBERSHIP

Our Board is currently comprised of ten directors: Diane M. Bryant, Gayla J. Delly, Raul J. Fernandez, Kenneth Y. Hao, Eddy W. Hartenstein, Check Kian Low, Justine F. Page, Henry Samueli, Ph.D., Hock E. Tan and Harry L. You. Mr. Hao was appointed to our Board in February 2024.

Mr. Fernandez is not standing for re-election and will serve on our Board until the Annual Meeting. At the Annual Meeting, the size of our Board will be reduced to nine directors.

DIRECTOR INDEPENDENCE

Our Board annually reviews the independence of each director and nominee and considers whether such individual has a material relationship with Broadcom Inc.that could compromise their ability to exercise independent judgment in carrying out their responsibilities. For the purpose of assessing a director’s independence, our Board reviewed transactions and relationships between Broadcom and an entity where a director or nominee serves as a director, executive officer and/or is the beneficial owner, directly or indirectly, of such entity, or where a director or nominee for director serves on a non-employee advisory board of or in a non-employee advisory capacity to such an entity.

Our Board has determined that Dr. Samueli, Mses. Bryant, Delly and Page, and Messrs. Hao, Hartenstein, Low and You, representing eight of our nine director nominees, are currently “independent” directors. Mr. Tan, who serves as our President and CEO, is not deemed an “independent” director. Our Board has determined that Mr. Fernandez, who will serve as a director until the Annual Meeting, is also an “independent” director.

BOARD LEADERSHIP STRUCTURE

Our Board currently believes that Broadcom and our stockholders are best served by a Board leadership structure in which the roles of the CEO and the Chairman of the Board are held by different individuals, and that there be a Lead Independent Director if the Chairman is not independent. Under this structure, our CEO is generally responsible for setting Broadcom’s strategic direction and for the day-to-day management of our operations. The independent Chairman and/or the Lead Independent Director, as applicable, provides strong independent leadership to assist our Board in fulfilling its oversight role of management and our risk management practices, approves the agenda for Board meetings and presides over Board meetings and over the meetings of our independent directors in executive session. Our Board annually reviews its leadership structure to determine whether it continues to best serve Broadcom and our stockholders. Currently, Mr. Tan serves as our President and CEO, Dr. Samueli serves as our independent Chairman of the Board and Mr. Hartenstein serves as our Lead Independent Director. Our Board has decided to continue the current leadership structure and division of responsibilities.

DIRECTOR NOMINATIONS

In accordance with the Corporate Governance Guidelines, our Board seeks individuals to serve as directors who have the highest personal and professional integrity, strength of character, demonstrated exceptional ability and judgment, and diversity of skills, experience and background appropriate for the business and operations of Broadcom.

When evaluating director candidates, the NESG Committee seeks to ensure that our Board has the requisite skills, experience and expertise, and that our Board consist of persons with appropriately diverse and independent backgrounds.

The NESG Committee considers all aspects of a candidate’s qualifications in the context of the needs of Broadcom, including:

personal and professional integrity, ethics and values

experience as an officer in corporate management

experience and expertise in our industries and international business, and familiarity with Broadcom

| | |  | | | 9 |

experience as a board member of another public company

practical and mature business judgment

diversity of background and perspective (including age, ethnicity, race, experience, gender and education)

Board size and composition and the extent to which a candidate would fill a present need on our Board

other ongoing commitments and obligations of the candidate

independence from management

The NESG Committee will consider nominee recommendations from its members, other Board members and members of our management, as well as nominees recommended by our stockholders. The NESG Committee has from time to time also engaged third-party search firms to assist in identifying and evaluating possible candidates.

See “Other Information — Stockholder Proposals and Director Nominations for the 2025 Annual Meeting” below for information on the requirements for director nominations, including nominations using proxy access.

DIRECTOR ATTENDANCE AND MEETINGS

The Corporate Governance Guidelines provide that each director is expected to attend all meetings of our Board and of each committee on which the director is a member and the annual meetings of stockholders. Our Board held nine meetings during fiscal 2023 and our independent directors met at regularly scheduled executive sessions without management present. Each director attended at least 75% of the aggregate number of meetings of our Board and all committees of our Board on which the director served during fiscal 2023. Eight of our nine directors then serving on our Board attended the 2023 annual meeting.

BOARD EVALUATIONS

Our Board is committed to reviewing its performance through an annual evaluation process, which is overseen by the NESG Committee. Through the evaluations, our directors provide feedback on our Board and its committees and assess its processes and overall effectiveness. The Chairman of the Board and the Lead Independent Director report the results to our full Board and the Chairs of each committee report the results to their respective committees.

BOARD RISK OVERSIGHT

Our Board believes that evaluating Broadcom’s most critical risks is one of its most important areas of oversight. Our Board regularly reviews and discusses with management risks related to operations, liquidity, credit, cybersecurity, climate, compensation programs, workforce retention and senior management succession.

10 | | |  |

In addition, each committee is responsible for the oversight of specific areas of risk and reports regularly to our Board on matters relating to those risks. Management reports, at least annually, on our risks and risk management practices to the relevant committees and the full Board.

Committee | | | Primary Areas of Risk Oversight | |||

Audit | | | • | | | Oversee financial reporting process, accounting policies and internal controls |

| | | • | | | Evaluate risks related to financial reporting, accounting, auditing, tax and fraud | |

| | | • | | | Evaluate exposures and risks related to cybersecurity, data privacy and information technology and its controls, including cybersecurity performance and monitoring, assessing and reporting such exposure | |

| | | • | | | Review and approve related party transactions | |

Compensation | | | • | | | Oversee compensation plans, programs and policies |

| | | • | | | Evaluate the relationship between risk management policies and practices, business strategy and compensation of executive officers and other executives | |

| | | • | | | Evaluate and provide input on CEO and senior management succession planning | |

NESG | | | • | | | Review and evaluate the corporate governance framework, including governance guidelines and policies |

| | | • | | | Evaluate the structure and composition of our Board and committees, including succession planning, diversity and related policies and procedures | |

| | | • | | | Oversee the corporate social responsibility and sustainability program and initiatives, including matters related to the environment, climate, diversity and inclusion, governance and human rights in the supply chain | |

Cybersecurity Risk Management

Our Board is actively involved in overseeing our cybersecurity, data privacy and information technology risk management. Our management, including our Chief Information Officer, in consultation with our Chief Information Security Officer, reviews with the Audit Committee at least quarterly our cybersecurity, data privacy and information technology security policies, practices and protective measures, current and projected threats to our data privacy and information security, cybersecurity incidents and related risks. Our Chief Information Officer also provides the Audit Committee at least quarterly an update on our enterprise security program that includes procedures and policies for testing vulnerabilities, responding to cybersecurity threats and providing a variety of cybersecurity, data privacy and incident response trainings to our employees. The Audit Committee and management also update our Board at least quarterly on our cybersecurity performance and risk profile and the effectiveness of our cybersecurity processes.

Compensation Risk Assessment

The Compensation Committee, in consultation with Meridian Compensation Partners, LLC (“Meridian”), conducts an annual review of our compensation policies and practices for our employees to assess the risks associated with such policies and practices. The Compensation Committee considered risk-mitigating factors in its review, such as our compensation policies and practices that provide a balance of short-term and long-term goals and awards and a mix of cash and equity components in the annual total compensation (as described below in “Compensation Discussion and Analysis” and “Executive Compensation”). The Compensation Committee also considered stock ownership guidelines, hedging and pledging prohibitions and its own oversight process which consists of independent directors.

BOARD COMMITTEES

Our Board has the following committees: Audit Committee, Compensation Committee, NESG Committee and Executive Committee. The Audit Committee, the Compensation Committee and the NESG Committee each operate under a charter that satisfies the applicable rules of the SEC and the Nasdaq Stock Market (“Nasdaq”) listing standards. The charters for all four committees are available in the “Investor Center — Corporate Governance — Documents” section of our website. Stockholders may also request a copy from Investor Relations, Broadcom Inc., 3421 Hillview Avenue, Palo Alto, California 94304.

| | |  | | | 11 |

The current members and chairs of the committees are provided below.

| | | Committees | ||||||||||

Name | | | Audit | | | Compensation | | | NESG | | | Executive |

Diane M. Bryant | | | | |  | | | | | |||

Gayla J. Delly | | |  | | | | |  | | | ||

Raul J. Fernandez | | |  | | | | |  | | | ||

Kenneth Y. Hao(1) | | | | | | | | | ||||

Eddy W. Hartenstein (Lead Independent Director) | | | | |  | | |  | | |  | |

Check Kian Low | | | | |  | | |  | | | ||

Justine F. Page | | |  | | | | | | |  | ||

Henry Samueli, Ph.D. (Chairman of the Board) | | | | | | | | |  | |||

Hock E. Tan (President & CEO) | | | | | | | | |  | |||

Harry L. You | | |  | | |  | | | | |  | |

| | | Member | | |  | | | Chair |

| (1) | Mr. Hao has not been appointed to any committees. |

Audit Committee

Each member of the Audit Committee is independent in accordance with the audit committee independence requirements under the applicable rules and regulations of the SEC and Nasdaq. Our Board has determined that Mses. Delly and Page and Mr. You are audit committee financial experts under applicable SEC rules and have the requisite financial sophistication required by applicable Nasdaq rules.

Members | | | Primary Responsibilities | | | Meetings in Fiscal 2023 | |||

Justine F. Page (Chair) Gayla J. Delly Raul J. Fernandez Harry L. You | | | • | | | Oversee the quality and integrity of financial statements, disclosure controls and procedures, and internal controls | | | 8 |

| | • | | | Determine the appointment, compensation, retention, qualifications and independence of our independent registered public accounting firm | | | |||

| | • | | | Conduct an annual performance evaluation of the internal audit function and independent registered public accounting firm | | | |||

| | • | | | Oversee financial and operational risk, including any exposures and risks related to data privacy and information technology systems controls, cybersecurity and fraud, and the steps management takes to monitor, control and report such exposure | | | |||

| | • | | | Oversee compliance with legal, ethical and regulatory requirements | | | |||

| | • | | | Establish procedures for the receipt, retention, investigation and treatment of complaints regarding accounting, internal controls and auditing matters | | | |||

| | • | | | Review related party transactions | | | |||

12 | | |  |

Compensation Committee

Each member of the Compensation Committee is independent in accordance with the compensation committee independence requirements under the applicable rules and regulations of the SEC and Nasdaq and is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Members | | | Primary Responsibilities | | | Meetings in Fiscal 2023 | |||

Harry L. You (Chair) Diane M. Bryant Eddy W. Hartenstein Check Kian Low | | | • | | | Determine executive officer (other than our CEO) base and incentive compensation | | | 5 |

| | • | | | Recommend to the independent directors CEO base and incentive compensation | | | |||

| | • | | | Design (in consultation with management or our Board) and evaluate compensation plans, policies and programs | | | |||

| | • | | | Administer equity-based plans and approve the terms of grants under those plans | | | |||

| | • | | | Confirm that compensation policies and practices do not encourage unnecessary risk taking | | | |||

| | • | | | Review and discuss, at least annually, the relationship between risk management policies and practices, business strategy and executive officers’ compensation | | | |||

| | • | | | Establish and periodically review policies concerning perquisite benefits | | | |||

| | • | | | Review and approve all employment agreements, severance and change-in-control arrangements and perquisites for executive officers and other executives (other than our CEO) and recommend to the independent directors such agreements and perquisites relating to our CEO | | | |||

| | • | | | Evaluate and provide input on CEO and senior management succession planning | | | |||

| | • | | | Review and make recommendations to our Board regarding compensation for non-employee directors | | | |||

| | • | | | Establish and periodically review stockholder ownership guidelines | | | |||

| | • | | | Provide oversight over the Compensation Committee’s compensation consultant | | | |||

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee, Ms. Bryant and Messrs. Hartenstein, Low and You, are not and have never been officers or employees of Broadcom. During fiscal 2023, none of our executive officers served on the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or the Compensation Committee.

| | |  | | | 13 |

Nominating, Environmental, Social & Governance Committee

Each member of the NESG Committee is independent in accordance with the applicable Nasdaq rules and regulations.

Members | | | Primary Responsibilities | | | Meetings in Fiscal 2023 | |||

Eddy W. Hartenstein (Chair) Gayla J. Delly Raul J. Fernandez Check Kian Low | | | • | | | Take a leadership role in shaping our corporate governance policies and procedures and develop recommendations for our Board | | | 4 |